For the year ended 31 December 2017

" A good result in an historic year for catastrophes"

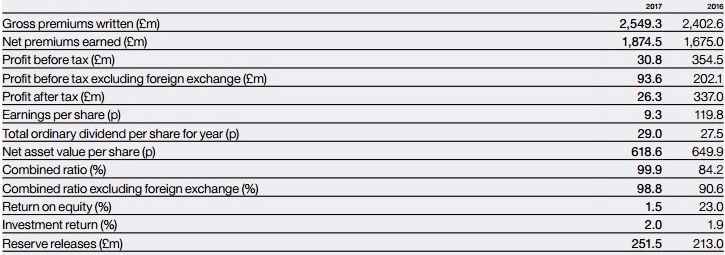

Group key performance indicators

Highlights

- Hiscox delivered a profit before tax of £93.6 million (excluding foreign exchange movements), despite setting aside net reserves of $225 million for claims in an historic year for natural catastrophes.

- Hiscox Retail now accounts for 56% of the Group’s gross written premium and its profits exceeded £100 million for the second consecutive year. Hiscox USA remains the standout performer with premium growth of 29% in constant currency.

- Hiscox London Market reduced premiums as planned by 20%, and is now set to grow as rates rise following the hurricanes, earthquakes and wildfires in the second half of 2017.

- Hiscox Re & ILS was profitable in a costly year for reinsurers, due to good underwriting on behalf of Hiscox and third-party capital providers. ILS assets under management now stand at $1.5 billion.

Bronek Masojada, Chief Executive of Hiscox Ltd, commented:

"Our long-held strategy of balance has served us well this year. The strong growth and profits in retail countered the volatility felt in our big-ticket businesses, which were impacted by an historic year for natural catastrophes. We have made significant investments in infrastructure and brand, both of which will continue. Market pricing has improved and as a consequence we have growth ambitions for every part of our business."

Click here for the full report

All press releases